Debt collection in Dubai is the process of claiming and pursuing unpaid money from companies that have failed to make their payments on time and past due date with a significant period.

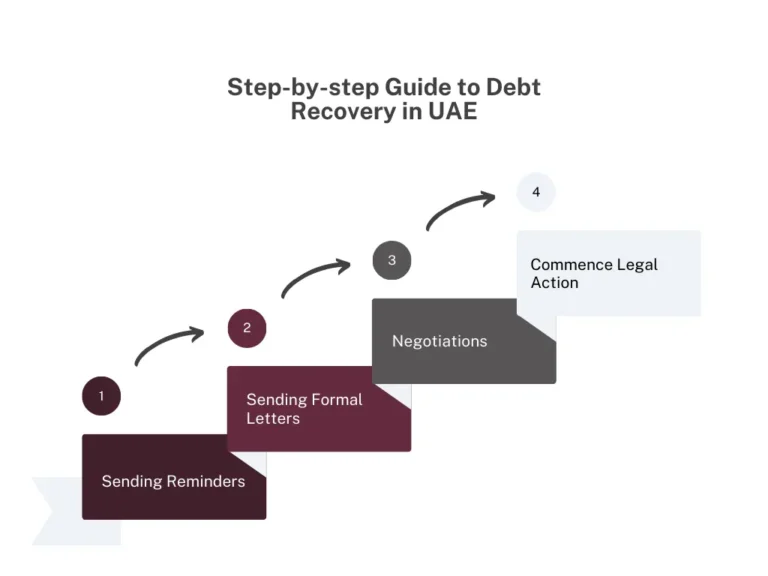

The debt collection process involves several steps in order, starting from locating the debtor’s location to contacting them until negotiating repayment terms then start collecting the actual dues and, if necessary, some creditors tend to take legal action to recover the outstanding debt if amicable attempts failed.

But before the debt collection lawyer in Dubai starts to do so, they ensure compliance with the debtor rights as it is crucial for businesses in UAE to protect themselves during the collection process.

Debtors always take advantage of their rights to ensure fair treatment, dispute illegitimate, chance for payment negotiations and protection against harassment and unfair practices.

Understanding Debt Collection Laws in Dubai: What You Need to Know

Debtors in the UAE are protected by specific laws that govern debt collection practices, ensuring fair treatment. So, it is essential for businesses who are going to claim for their outstanding amount to hire debt collection lawyer in Dubai because they are best placed to know these laws and how to deal with debtors without violating them, which would hinder the collection process.

The best debt collection lawyer in Dubai provides a framework for debt recovery procedures, outlining the steps that creditors must follow when attempting to collect a debt. By understanding these regulations by an expert debt collection lawyer in Dubai, both creditors and debtors can ensure that their rights are protected throughout the collection process.

How do you deal with Debt Collectors in Dubai

When dealing with debt recovery lawyers in Dubai, It is important to know your corporate rights and available approaches for taking the proper steps. Understanding how the debt recovery lawyers in Dubai work can help alleviate some of the stress associated with financial difficulties.

Know your rights

Consult with a debt collection lawyer in Dubai to familiarize yourself with the laws and regulations surrounding debt recovery agencies in UAE to ensure that you are being treated fairly and within legal boundaries.

Respond Promptly

If you receive a call from a debt collection lawyer in Dubai, do not ignore it. Respond immediately and gather all relevant information regarding the debt in question.

Communicate Clearly

Maintain open communication with the debt collection lawyer in Dubai but be cautious about providing sensitive information without verifying their identity.

Negotiate a Settlement

If possible, try to negotiate a settlement or repayment plan that works for both parties.

Keep Records

Document all communication with the debt collection lawyer in Dubai, including dates, times, and details of discussions, for future reference.

Ensuring Fair Debt Collection Practices for Debtors

Legal professionals play a crucial role in ensuring fair debt collection practices for debtors in UAE. Debt recovery lawyers in Dubai specialize in navigating the complex legal landscape surrounding debt collection practice, protecting the rights of debtors, and ensuring that all collection efforts adhere to the law.

Debtors in Dubai can seek legal assistance as well from experienced debt collection attorneys to safeguard their rights and interests if they feel so. Hiring a reputable debt collection lawyer in Dubai can provide debtors with valuable guidance, representation, and advocacy throughout the debt collection process.

Conclusion

By working closely with skilled legal professionals, debtors can ensure that their rights are protected, unfair practices are challenged, and negotiations with creditors are conducted fairly and transparently. Legal assistance for debtors in Dubai is essential for upholding justice and ensuring a level playing field in matters involving debt collection companies in the UAE.

Does your business need it? Get the best debt collection services for your business. Contact us.

debt recovery lawyers in dubai

Yes, you can file a case against someone who owes you money in Dubai. The legal framework in the UAE allows creditors to take action through the courts to recover debts.

What happens if you can't pay your debt in Dubai?

Creditors may initiate legal proceedings against you for recovery of the owed amount, plus travel restrictions and bank account freezing.

AW Holding

AW Holding