Research shows that many entrepreneurs are unaware of the intricacies involved in the process of debt recovery in UAE, often leading to costly mistakes and prolonged legal battles. In the business world, every decision can make or break your business, having the right knowledge and guidance is essential.

Imagine this: you’ve extended credit to a client, only to find yourself chasing after unpaid invoices, facing mounting financial losses, and strained business relationships. Without a solid understanding of procedures of debt recovery in UAE, you could be left vulnerable to exploitation and uncertainty.

In this blog, we will delve into the procedures of debt recovery in UAE, providing you with the expert guidance and calculated steps necessary to navigate this challenging terrain.

Table of Contents

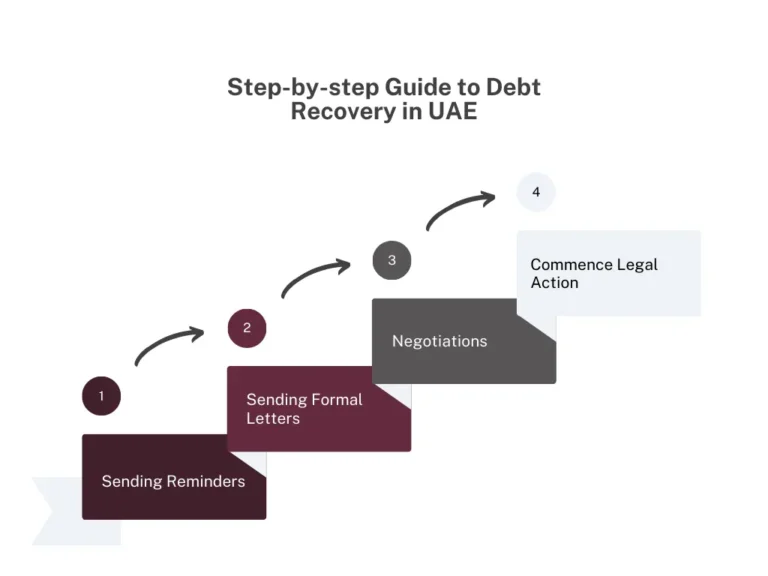

ToggleStep-by-step Guide to Debt Recovery in UAE:

Time is a precious commodity nowadays in the world of business and acting fast is very important as we work in fast based economic environment, whether you are a Start-up or large corporate you want to dedicate your most time focusing on operation instead of chasing late payments but when it does happen, here is a directory for creditors to follow when starting debt recovery UAE.

1 – Sending Reminders:

Start softly with your customers by sending gentle reminders for invoices they need to pay; you must ensure they are notified of them by email or phone calls or receive a hard copy of the invoices they need to pay.

The invoices should clear the follow:

- Your contact details

- Clear description of the amount they need to pay.

- Payment methods, terms and due date.

- Contact references (for your company)

2 – Sending Formal Letters:

A common action in the process of debt recovery in UAE, if you haven’t received the payment or any respond from the client, then you may stop being nice and send a formal late payment notice, sometimes it called Letter Before Action (LBA).

- It doesn’t matter what the name is, but it matters what is included, such as:

- Previous attempts to reach out or remind the client.

- All the details of the payments to be paid.

- Referring to intention of legal action if you don’t receive the payments in specific dates as final appointment.

3 – Negotiations:

If the debtor responded to your correspondences, you shall consider setting down and talk, whether he asked it or not you have to go on a negotiation round to reach a settlement plan that works for both of you, not all the debtors want to evade the creditors or bypass their due dates, they may really face financial problems prevent them from paying although it against their intention, so while implementing these approaches during debt recovery in UAE try to be open and flexible to get the maximum returns.

4 – Commence Legal Action:

If your formal letters haven’t being replied, still no connection or returning to emails or phone calls by the debtor to your communication and debt is still unpaid or settled in the negotiations meet-ups, you may consider taking legal action as a last resort to save your rights.

The legal process, often a lengthy process and costly not just in the UAE but worldwide, add to that the potential damage to the business relation between you and your client that will definitely harm in future contributions, nevertheless if you didn’t prepare well for the case by collecting all the needed documents and hiring the good lawyer you still have a chance to lose it.

Alternative Dispute Resolutions & Payment Methods for Debts in the UAE:

You must know that failing in collecting what’s rightfully yours or proceeding with court to collect the due amounts because of the cost is not the end of the route for debt recovery in UAE, there are different options in amicable and legal ways to collect your money or the biggest amount from it such as:

1 – Mediation

Mediation is a form of alternative dispute resolution where a neutral third party, known as a mediator, helps the parties involved in a dispute to reach a mutually acceptable agreement. Unlike litigation, which can be time-consuming, expensive, and adversarial, mediation offers a more collaborative and flexible approach to resolving conflicts.

Watch now and master mediation for B2B debt settlement!

2 – Arbitration

It is a way to resolve conflicts outside the traditional court system. Arbitration offers several benefits that make it an attractive option for those looking to avoid litigation’s time, expense, and uncertainty.

These are alternative legal options in debt recovery, but there is another fast financial approach you may consider if you are in urgent need of cash flow.

3 – Invoice Factoring

Factoring companies buy your issued invoices and pay you a percentage of total amount, normally it could reach 90% of the total invoice amount in return, it collects the full amount from debtors upon due dates.

4 – Deal with a Debt Collection Agency

Dealing with debt collection agencies is one of the most effective ways for debt recovery in UAE, they employ best practices and proven strategies to collect B2B debts by specialized expert team of debt collectors with legal background and strong negotiations skills, also some of the debt collection agencies just like AW UAE works with no collection, no fees policy and don’t charge any other hidden or up-front fees, only a percentage of the debt when it’s collected.

5 – Selling the Debt

Selling the debts is like legal action should be your last resort of the other attempts for debt recovery in UAE, a third company can offer buying the debt from you but with less significant price than the total amount owed. Then the debt purchaser takes full responsibility of dealing with the debtor and trying to collect from him as much as he can.

In Conclusion

By implementing the effective debt recovery strategies outlined in this blog, you can now confidently pursue and collect outstanding debts. Don’t let unpaid debts linger any longer – act today and secure the funds you are owed.

Subscribe freely to our newsletter for more valuable insights and tips on debt recovery to ensure your financial success!

Let’s work together to empower you with the knowledge and tools needed to navigate the process of debt recovery in UAE successfully.

AW Holding

AW Holding