Debt collection analytics become an essential part for finance companies when they plan to give credit, every lender nowadays investigates the debt collection predictive analytics so he can assess the ease and guarantee of recovering his money back whether by a debt collection software analytics or analyzing the data, insights and previous record of the borrower to help make data-driven decisions.

In this Blog we will discover the major KPIs for debt collection analytics, that you can use for microfinancing, credit assessment, and assess the collection agency you are dealing with.

Table of Contents

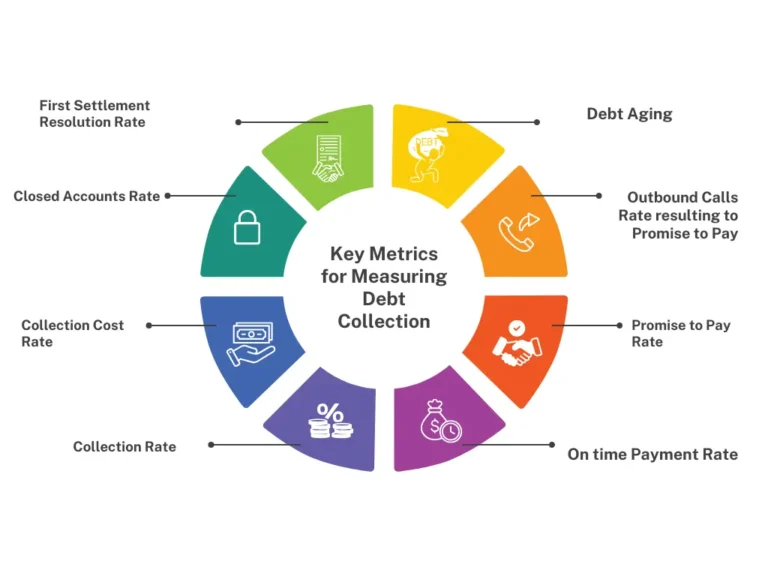

Toggle8 Key Metrics for Measuring Debt Collection Performance:

1 – Debt Aging:

Debt aging provides valuable insights into the success of collection efforts and the overall health of a debt portfolio.

Debt aging measures the length of time a debt has remained unpaid, categorizing it into different time frames such as 30 days, 60 days, 90 days, 180 days, 365 days and so on. This metric reflects the effectiveness of collection strategies, as debts that remain outstanding for longer periods often indicate challenges in securing repayment.

2 – Outbound Calls Rate resulting to Promise to Pay:

This debt collection analytics metric is very important especially when assessing the cost of collection to the collected amount, it’s crucial for the agencies itself to see if the signed accounts are profitable enough to the efforts made plus to the creditor to see the efforts made with each debtor until reaching the promise to pay phase, also gives an slight indicator to his creditworthiness for future deals.

(To calculate this percentage, use the following formula: Outbound Calls Resulting to Promise to Pay Rate = (The Number of Outbound calls made until reaching PTP / Total Number of Outbound Right Party Contacts) x 100)

3 – Promise to Pay Rate:

We use it in the debt collection analytics so we can forecast how much we are expecting to collect in the upcoming period, it also gives us an outlook that we can provide to the creditor to manage his expectation about the future payments and gives him insights to better cash flow management.

(To calculate this percentage, use the following formula: Promise-to-pay rate = (Number of promised payments / Total outstanding debt) x 100)

4 – On time Payment Rate:

Measures the number of payments made on the promised date given by the debtors to fulfill their obligations, promises can easily be broken by the debtors and usually deceptive, what proves otherwise is the on-time payment rate on our debt collection analytics.

(To calculate this percentage, use the following formula: On-time payment percentage = (Number of on-time payments / Total number of promises made) x 100)

5 – First Settlement Resolution Rate:

You need to pay attention to this metric especially when you have a large portfolio with the debt collection agency, this debt collection analytics metric tells you the percentage of settlement reached with the debtors from the first communication happened, it also assesses the efficiency of the debt collection agency you are dealing with and a positive indicator about the debtor creditworthiness.

(To calculate this percentage, use the following formula: First settlement resolution rate = (Number of settlement agreed on the first contact / Total number of settlements agreed) x 100)

6 – Closed Accounts Rate:

A huge debt collection analytics part for both creditors and debt collection agency This rate refers to the closed cases without collection due to many reasons such as: the inability to reach the debtor and refuse to pay or reach a settlement, this rate has inverse relationship with the collection rate, the lower is this percentage the higher the collection percentage will be.

(To calculate this percentage, use the following formula: Closed Account Rate = (Number of closed cases without collection / Total number of assigned cases) x 100)

7 – Collection Cost Rate:

This debt collection analytics calculate the cost occurred per debtor or per account to collect the debt, the cost can be measured by the total number of calls whether domestically or internationally, skip tracing tools subscriptions to reach the debtor locations, number of visits happened to negotiate or remind the debtor, any other form of communication to inform about the debt other than the email like fax or postal delivery, add to that the agents salaries plus if the debt collected by a third party in other country, you will include the fees or the percentage cut this partner.

This debt collection analytics is the main aspect for the collection agency to decide whether to accept this case for collection or not, remain or resign with the same account or not.

(To calculate this percentage, use the following formula: Cost Per Collection = (Total Collection Costs / Amount of debts collected) x 100)

AW UAE Credit Risk Advisory:

Credit Risk analysis is part of AW Holding supply chain (one stop solution) and attached to our main service which is receivable management service (early accounts receivable collection), because our main goal is not only solving your current dues but prevent it from happening again by studying your corporate debt portfolio analytics

we provide you with a comprehensive recommendation about the credit situations for all your clients you’ve been dealing with and predict which client is mostly unlikely going to pay the invoices on time which will cost you using collection services like ours to grab those invoices again.

With our credit reporting you will be having a clear vision of the markets that you should remain with and the markets that you should shifting from due to their payment behavior.

8 – Collection Rate:

Most important debt collection analytics, it refers to the percentage of the actual collected amount of the outstanding debt based on the agreed settlement or collection efforts made by the collection team, this percentage indicate how effective the debt collection agency you are dealing with, strategies that have been utilized and the skills of its debt collectors.

(To calculate this percentage, use the following formula: Debt collection rate = (Total debt collected / Total outstanding debt) x 100)

Other KPIs:

Besides the above debt collection analytics measures, their other metrics of success you may include related to marketing and sales which refers to the cost per acquisition, this also can be added to the collection cost, follow us on social media and subscribe to our newsletter to get new updated information about the industry and more insights.

FAQs

What is debt collection analytics software?

It’s a system created to track payments of the debtors, analyze the efforts and activities made by the collection agency, provide historical data, payment patterns, store all the documents and related to the cases so that we can predict future payments by the debtors and measure the performance of the agency.

What are the three C's of a successful collection's strategy refers to?

It refers to communication, choice and control.

What are the three ways to manage debt?

- Collect all the documents about the debtors.

- Determine how much you need to collect.

- Hire a debt collecting agency to grab the money for you.

AW Holding

AW Holding