Cashflow is the fuel to your business operations and accounts receivable collection is the station where you fill from, and in world of business that only knows the data language you need to be empowered and well-known of how to read the key performance indicators to measure the collection efforts made for your accounts receivables, the number one source of cash generated from your business.

In this blog we will take you step by step for every effective KPIs for accounts receivable collection, understanding it, the formulas and calculations, but before we start our journey with the analytics let’s first know what it is and why is it important to know.

Table of Contents

ToggleWhat is KPIs for Accounts Receivable?

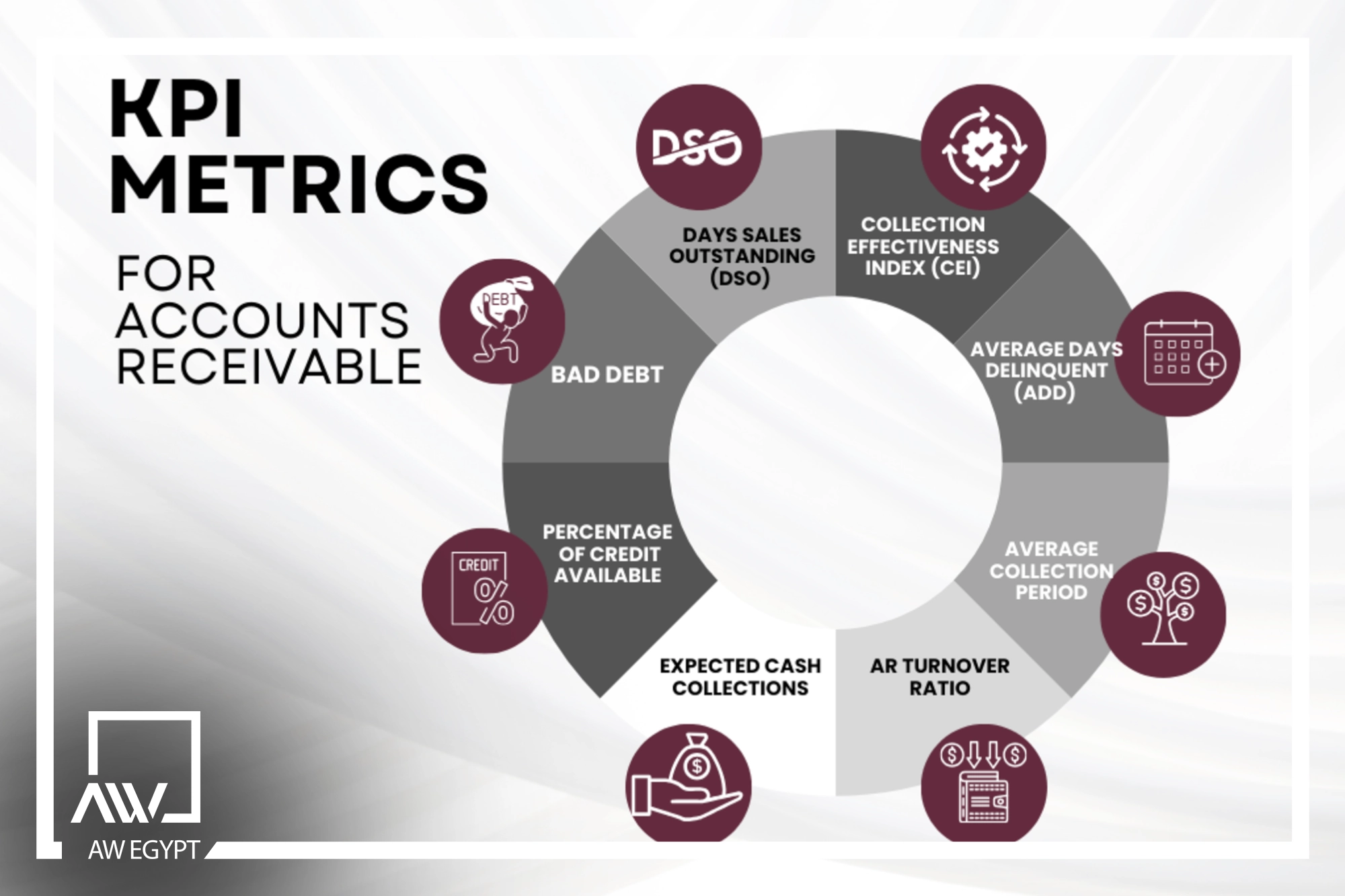

The key performance indicator or (Kips) are the metrics that you assess the amount of cash flow incoming to your bank accounts from your sales activities to be able to run your business operation smoothly and making profits, it depends on some major metrics include but not limited days sales outstanding (DSO), ageing of accounts receivable, collection effectiveness index (CEI), bad debt ratio and credit risk.

8 Effective KPI Metrics for Accounts Receivable

1 – Days Sales Outstanding (DSO)

First kips for accounts receivable is the (DSO), It refers to the time being taken to collect the receivables starting from the date of making the sale.

Long DSO means that your company usually takes long time to receive or collect the amount of sales revenue from the clients which it has negative effects on your financial stability over the time as you need to meet your corporates financial obligations like the accounts payable.

How to calculate the DSO?

Formula: Days Sales Outstanding = (Accounts Receivable / Net Credit Sales) * Number of Days

P.s: to calculate the net credit sales use the following formula as well: (Sales on credit – Returns and sales Allowances) = Net Credit Sales

Example:

Let’s assume a company has the following information for a specific period:

Beginning Accounts Receivable: $100,000

Ending Accounts Receivable: $120,000

Net Credit Sales: $500,000

Step 1: Calculate Average Accounts Receivable:

Average Accounts Receivable = (Beginning Accounts Receivable + Ending Accounts Receivable) / 2

($100,000 + $120,000) / 2

= $110,000

Step 2: Apply the DSO formula:

DSO = ($110,000 / $500,000) * 365

= 0.22 * 365

= 80.3 days

2 – Collection Effectiveness Index (CEI)

Second kips for accounts receivable is the (CEI) It is an index gives you a percentage, a percentage that shows the how many of your receivables collected during a certain period, this metric measure the effectiveness of your collection performance while the DSO measures how fast these collection actions are done.

How to calculate the CEI?

Formula: Collection Effectiveness Index = [(Beginning AR Balance + Credit Sales During Period) – Ending Total AR Balance] ÷ [(Beginning AR Balance + Credit Sales During Period) – Ending Current AR Balance] x 100

Breakdown:

- Beginning AR Balance: the amount in outstanding AR the company has at the start of the period.

- Credit sales during period: the total sales made on credit during the period.

- Ending total AR Balance: the amount in outstanding AR at the end of the period.

- Ending Current AR Balance: the total of all payments received for credit sales made during the period.

Example:

Step 1: Calculate the numerator:

(Beginning AR Balance + Credit Sales During Period) – Ending Total AR Balance

= ($100,000 + $200,000) – $150,000

= $150,000

Step 2: Calculate the denominator:

(Beginning AR Balance + Credit Sales During Period) – Ending Current AR Balance

= ($100,000 + $200,000) – $50,000

= $250,000

Step 3: Calculate CEI:

CEI = ($150,000 / $250,000) * 100

= 0.6 * 100

= 60%

3 – Average Days Delinquent (ADD)

The third kips for accounts receivable (ADD) refers to how many days your invoices are delinquent or pass the due date.

Higher ADD means that your clients are very slow in their payments, which would allow you to implement future payment terms to reduce this negative point.

How to calculate the ADD?

Formula: Average Days Delinquent = (DSO – BPDSO)

Breakdown:

- DSO: Refer to the first kips for accounts receivable

- BPDSO: which means Best Possible Days Sales Outstanding = (Current Accounts Receivable ÷ Total Net Credit Sales) x Number of Days in Period

Example:

Step 1: Calculate BPDSO:

BPDSO = (Current Accounts Receivable / Total Net Credit Sales) * Number of Days in Period

= ($120,000 / $500,000) * 30

= 0.24 * 30

= 7.2 days

Step 2: Calculate ADD:

ADD = DSO – BPDSO

= 80 days – 7.2 days

= 72.8 days

Watch the following clip explaining the above metrics perfectly to have a clear vision:

4 – Average Collection Period

The fourth kips for accounts receivable is for calculating the average number of days it takes a business to collect and convert its accounts receivable into cash, you may find it similar to the DSO the first Kips for accounts receivable measurement but the DSO focus on the average days it takes to collect from the day of sales made but the average collection period focuses on the number of days takes to collect the receivable when it became amount due.

How to calculate the Average Collection Period?

Formula: Average Collection Period = 365 Days ÷ Accounts Receivable Turnover Ratio

Breakdown:

Accounts Receivable Turnover Ratio: we will explain it in the next metric of kips for accounts receivable, Keep reading!

Example:

Let’s assume a company has the following information for a specific period:

- Average Accounts Receivable: $100,000

- Net Credit Sales: $500,000

Step 1: Calculate Accounts Receivable Turnover Ratio:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

= $500,000 / $100,000

= 5

Step 2: Apply the ACP formula:

ACP = 365 Days / 5

= 73 days

5 – AR Turnover Ratio

The fifth kips for accounts receivable is for measuring the performance of your first party or third-party collection team from your clients, meaning measuring the average collection amount on a given period (monthly, Quartey or annually).

A high accounts receivable turnover ratio indicates that your collection team is collecting the amounts very fast from the clients.

How to calculate the AR turnover ratio?

Formula: Accounts Receivable Turnover Ratio = Net Credit Sales ÷ Average Accounts Receivable

Breakdown:

- Net Credit Sales = Sales on Credit – Returns and Sales Allowances

- Average Accounts Receivable = (Starting Receivables + Ending Receivables) ÷ 2

Example:

Let’s assume a company has the following information for a specific period:

- Net Credit Sales: $500,000

- Starting Receivables: $100,000

- Ending Receivables: $120,000

Step 1: Calculate Average Accounts Receivable:

Average Accounts Receivable = (Starting Receivables + Ending Receivables) / 2

= ($100,000 + $120,000) / 2

= $110,000

Step 2: Apply the AR Turnover Ratio formula:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

= $500,000 / $110,000

= 4.55

Wants to dive deeply in this (kips for accounts receivable), the metric of AR Turnover Ratio, you can read our article designed only for this metric: Accounts Receivable Turnover Ratio| Formula and how to Calculate

6 – Expected Cash Collections

The sixth kips for accounts receivable metrics of success is the amount of cash you expected to be having it in a given time, as there are two sources of cash for your corporates which is the immediate cash you have right now when your customers pay on spot and the expected collected cash from your accounts receivable which we are about to measure.

How to calculate the expected cash?

Formula: Expected Cash Collections = Cash Sales + Projected Collections from Accounts Receivable

Example:

Let’s assume a company has the following information for the upcoming month:

- Cash Sales: $20,000

- Projected Collections from Accounts Receivable: $50,000

Step 1: Apply the formula:

Expected Cash Collections = $20,000 + $50,000

= $70,000

Want new ways to increase your corporate cash flow, book a free consultation now with our Business Development Experts: https://alwadiholding.com/aw-egypt/contact/

7 – Percentage of Credit Available

The seventh kips for accounts receivable is the percentage of credit availability to the clients, the accounts receivable department should be the concern party of allowing or caping the limit of credit amount for clients to buy on based on the metrics shown for their performance of payments and collection.

Check our credit risk advisory service from AW Egypt to have better decisions for your credit management.

How to calculate the percentage of credit available?

Formula: Percentage of Credit Available = (Total Credit Extended / Total Credit Limit) * 100

Example:

Let’s assume a company has a total credit limit of $100,000 and has extended credit to customers totaling $80,000.

Step 1: Apply the formula:

Percentage of Credit Available = ($80,000 / $100,000) * 100

= 0.8 * 100

= 80%

8 – Bad Debt

The eights kips for accounts receivable are the bad debt or in other words (the write off) the bad debt is the amount of money which your corporate is losing hope in recovering this money, it tends to pass from 3 to 5 years of not having any progress of collecting this money, low bad debt rate is a good indicator for your financial performance as this consider direct loss for your business.

You can now turn the losses into profits by collecting your bad debts portfolio using our Debt Collection service, check it out from here and send it over to us.

How to calculate the amount of bad debt?

“There are two common methods to estimate bad debt”

Formula:

1 – Percentage of Net Credit Sales Method:

This method estimates bad debt as a percentage of net credit sales.

Estimated Bad Debt Expense = Net Credit Sales * Estimated Percentage of Bad Debt

Example:

Let’s assume a company has net credit sales of $1,000,000 and estimates that 2% of these sales will be uncollectible.

Estimated Bad Debt Expense: $1,000,000 * 2% = $20,000

- Aging of Accounts Receivable Method:

This method estimates bad debt based on the age of outstanding accounts receivable. Older accounts are typically considered more likely to be uncollectible.

Example:

Let’s assume a company has the following aged accounts receivable:

- 0-30 days: $50,000 (Estimated bad debt: 1%)

- 31-60 days: $30,000 (Estimated bad debt: 5%)

- 61-90 days: $10,000 (Estimated bad debt: 10%)

- Over 90 days: $5,000 (Estimated bad debt: 50%)

Estimated Bad Debt Expense:

($50,000 * 1%) + ($30,000 * 5%) + ($10,000 * 10%) + ($5,000 * 50%) = $3,500

Wants to have more information about the aging accounts receivable, have a look on our specialized blog Past Due Account Receivables| AR Aging Report contains examples and templates of AR ageing reports and how to produce it.

Why is KPIs for accounts receivable important?

It is very important to assess the efforts made by your collection team or collection agency for your corporate sales amount because it is the number one source for your business income is the sales you made on credit with your clients, based on what shown from the kips for accounts receivable you can take immediate actions to correct direction for your corporate collection performance and keep running smooth cash flow.

Have a look at the designed receivable management service that is tailored based on your industry flow and accounting system.

In conclusion:

We have explored several (key performance indicators) KPIs for accounts receivable, that are essential for managing and optimizing cash flow within a business. Understanding metrics such as Days Sales Outstanding (DSO), Collection Effectiveness Index (CEI), Average Days Delinquent (ADD), Average Collection Period, AR Turnover Ratio, Expected Cash Collections, Percentage of Credit Available, and Bad Debt can provide invaluable insights into the efficiency of your credit and collection processes.

You can right now have AW Egypt takes the charge of your whole accounts receivable cycle starting from invoicing till collection and provides you with detailed kips for accounts receivable and the performance and free of charge credit risk advisory service.

Contact us now and a have a free consultation right away.

AW Holding

AW Holding