The consensus that business owners spend 25% of their time engaging with customers, add to that the regular tasks of marketing and operations, how much could be left during the week?

The last thing you need is to spend time on a minor task like following up on invoices payment but with insufficient way of doing this task, it could be the worst headache for you.

This blog post will provide a comprehensive guide on the steps to take when chasing late payments, ensuring your business maintains a healthy financial position. From polite reminders to legal action, we’ll cover the strategies to help you get paid on time.

Table of Contents

ToggleWhat is a Past Due Invoice?

Due invoices are the bills that issued based on a selling goods or services to another party, but the fees haven’t been paid yet, the payment date is scheduled to a future appointment normally ranges from 14, 30, 60 or 90 days, this is a common selling way between traders, so the seller need to book these selling transactions in his records with something called accounts receivable until receiving his full amount these transactions change to income in your financial statements.

So, when following up on invoice payment, you need to issue bills whether in hard copies or electronic copies to confirm their receiving for the service or goods as proof and you can follow up with them until you get your money.

Why is it important to follow up on Invoices Payment?

Unfortunately, following up on invoice payment became vital for your business if you don’t use the prepaid way when selling your product or service, so to keep your business afloat you need to maintain a healthy cash flow that comes from the thing that you sell on credit here.

And expecting commitment from other parties on payment dates doesn’t go easy as you think, even if it’s on paper unless some people strain this point with late fines and interest to be paid in case not meeting the payment dates to encourage prompt payment, but late payment fees can obstruct your business deals from the first place and affect your negotiations for selling and closing therefore you are somehow forced to sell on credit to complete the deal.

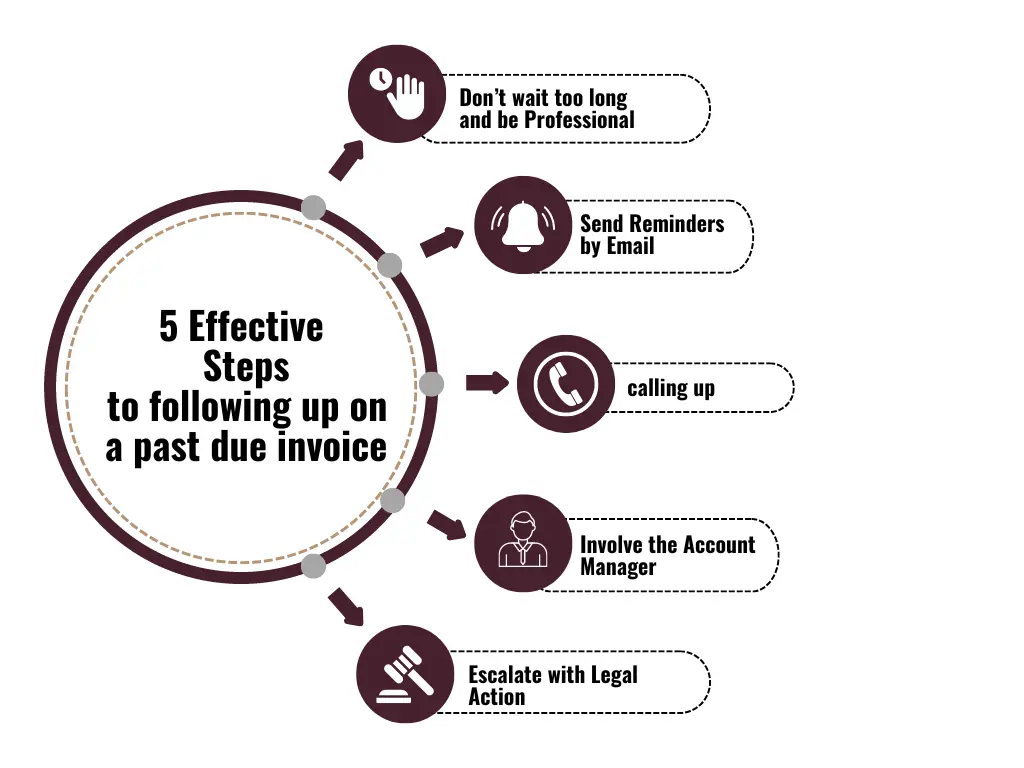

5 Effective Steps to following up on a past due invoice:

1 – Don’t wait too long and be Professional:

It’s very serious not to let the past due be unpaid for long time, in fact some people think that following up on invoice payment is an annoying thing and can be pushy in unprofessional way, which is not, nothing could be more unprofessional than not honoring your agreements with other parties.

On the other hand, your business dealers are very committed, but the payment delay is happening because a misunderstanding or simple issue like he forgot to pay, lost your email, there is an error with the invoice, or simply he didn’t receive what you were agreed to.

2 – Send Reminders by Email:

Once you have obtained a confirmation on the invoices you may start tailoring a reminding strategy through emailing based on the timeline you have till the due date, usually you start with gentle reminders but that doesn’t mean you will keep asking nicely or being rude or adopting threaten tone of voice afterwards, always keep a professional and formal tone in your writing for following up on invoice payment.

Here is an Email Template for reminding:

“Subject: Invoice Payment Reminder

Dear [Client Name],

I hope this email finds you well. I am writing to kindly remind you about the outstanding invoice payment from [invoice date].

As per our agreement, the payment for invoice number [invoice number] amounting to [invoice amount] was due on [due date]. Unfortunately, we have not received the payment yet.

I understand that sometimes things can slip through the cracks, but prompt payment is crucial for the continued operation of our business. I would greatly appreciate it if you could please make the payment at your earliest convenience.

If you have any questions or concerns about the invoice, please contact me. I am happy to discuss and find a resolution.

Thank you for your attention to this matter. I look forward to receiving the payment soon.

Best regards,

[Your Name]

[Your Title]

[Company Name]”

3 – Try calling up:

If you haven’t heard back from them on your emails in course of two weeks or more, try following up this time with direct phone calls, faxing may not be efficient by telephoning is way better when following up on invoice payment, also it may clear other concerns affecting the payment process so you can have the chance to discuss it freely and immediately.

4 – Involve the Account Manager:

I’m sure you have heard the saying of don’t involve account managers in the collection matters, sales and relationship people is better not to communicate this racket subject, but guess what, selling without collecting is nothing, it’s a punishment for your corporate and to the account managers in the frontline, here the financial target turn to non-financial because the income is on the paper not in the bank accounts, so account manager definitely will help you on following up on invoice payment.

5 – Escalate with Legal Action:

If the amount is significant and as a final resort, you may consult with a lawyer about what the next steps to be proceeded to claim your amounts.

What happens if you don’t follow up on invoices Payment?

Cash flow issues may occur with high possibility rate, this is not a personal opinion by the way, but small survey with your business network will assure that the cash flow is main problem and challenge they face with their businesses.

when you not Cash flow issues come from two things:

One thing: is not meeting your sales target or weaknesses on to production to supply the demand on the market.

The other thing: is not collecting or receiving your money on your planned dates due to not following up on invoice payment.

And when you have low liquidity, you may face problems securing your workers’ salaries, company utilities and liabilities, inability to enter new investment projects or even handicaps to start a new production process or complete an ongoing one to meet buyers’ requests.

FAQs

How to follow up an invoice Politely?

Start with a friendly, non-confrontational approach. Something like “I hope this email finds you well. I wanted to follow up on the invoice I sent on [date] for [amount]. Please tell me if you have any questions or need more information from me.

Provide relevant details. Include the invoice number, date, and total amount owed to jog the client’s memory. This shows you’re organized and makes it easier for them to locate the outstanding payment.

How do I reply to overdue payment emails?

When responding to an overdue payment, strike a professional and diplomatic tone: Acknowledge the overdue payment: “I understand the [invoice/project] payment due on [date] has not been received. “Explain the situation neutrally, avoiding blame. Propose a resolution, such as a payment plan or extension. Be open to negotiation. Reaffirm your commitment to resolving the matter promptly. Close professionally.

How do I write an email about past due invoices?

Here is a more concise version of the email text: I’m writing to follow up on the overdue invoice(s) [invoice number(s)] dated [date(s)]. As per our agreed payment terms, this invoice was due [due date]. Prompt payment is crucial for our cash flow and service continuity. Please let me know if you have any issues or need a suitable payment plan. I would appreciate you arranging payment at your earliest convenience.

AW Holding

AW Holding