Imagine having a bag of alternative solutions to unpaid invoice recovery, each one designed to tackle the daunting task of recovering those elusive payments.

In this blog we will empower you with the best ways, tips & tricks for unpaid invoice recovery, whether through technology, online, offline or legal courts.

Table of Contents

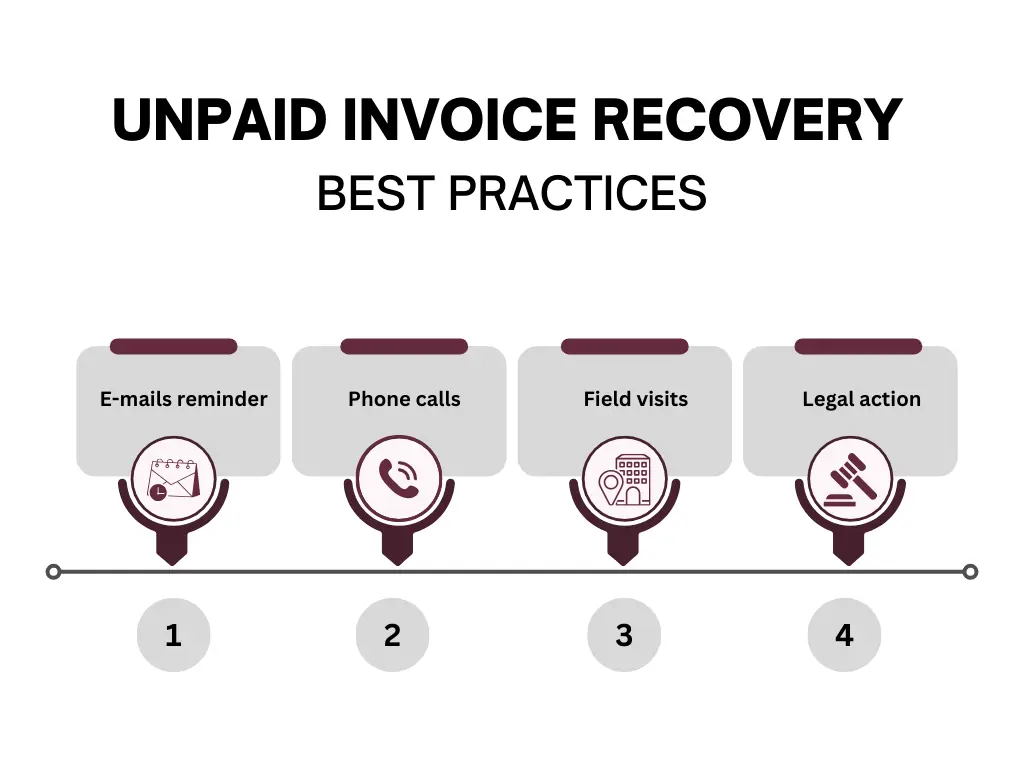

ToggleBest Practices for Unpaid Invoice Recovery

1 – Online Recovery:

Through reminder emails, which are the most popular tool for unpaid invoice recovery, companies set either automated email strategy or handmade one tailored to each account based on your capacity and depending on the client’s behavior.

2 – Offline Recovery:

It could be more effective as most of the times the clients don’t open or reply to the emails related to payments, and they may prefer to communicate over the phone for payment method and condition conformation, also offline doesn’t mean conducting phone calls only as they may not answering it too, and eventually find yourself making field visits or send representatives asking collecting the invoices amount.

3 – Legal Recovery:

Is the final card used for companies to recover outstanding invoices amounts, firms thinking many times before persuading legal action for unpaid invoice recovery due to the legal cost, length and client relationship, but sometimes it could be the only possible option to recover what is rightfully yours.

Role of Technology for Unpaid invoice Recovery

Technology could be time saver and cost-effective option for your collection, Businesses are increasingly turning to specialized software solutions designed to automate and simplify the recovery of outstanding payments.

These tools can track invoices, send reminders, and even facilitate communication with clients regarding overdue accounts.

One significant advantage of using technology for unpaid invoice recovery is the ability to analyze payment patterns and identify trends that may indicate potential issues with specific clients or sectors.

This data-driven approach allows businesses to proactively address concerns before they escalate into larger problems. Additionally, automated systems can significantly reduce the time spent on manual follow-ups, enabling finance teams to focus on more strategic tasks.

What are the Causes of Unpaid Invoices?

Not every time the reason for unpaid invoices come from your client side, we always accuse that the customers are delaying their payments for their sake of having the money for longer period or intending to gain a discount due to the struggling of collecting or having a possibility to get the service or good requested for free.

We don’t pay attention that the cause of the delay maybe happened because of us due to:

Poor communication:

Clients may not pay invoices due to poor communication coming from the seller side about the terms and condition of the contracts or purchasing transactions, or misleading information shared about the payment dates or channels.

Inaccurate invoicing:

Errors in invoices such as client names, wrong product ID or reference numbers, unmatched invoice numbers, wrong amount numbers, listing unused services in the bills or sometimes listing amounts that wasn’t disclosed before like VAT or taxes or service fee that may cause customer disputes.

Complex payment processes:

Sometimes due to the complexity of payment process customer may delay their payment for inconvenience, or the non-diverse payment options like you only take cash and not enabling bank transfers or there is no option for other online payment gateways or vice versa.

Lack of follow-up:

Customers may not lose the intention of timely payments, but they just need reminders, you have set up an automated friendly reminder process or system to avoid harder unpaid invoice recovery activities.

How Do Unpaid Invoices Affect your Business?

Meeting Obligations:

The money of the unpaid invoices is your revenue and when your income is stopped for a certain amount of time you won’t have the ability to pay your corporate obligations such as: salaries, utilities and production cost.

Investment Projects:

Not having enough liquidity is a huge obstacle for your investments whether expanding into new markets or opening and new branch, launching a new product line or hiring more employees, all of this can be stopped if you don’t recover your invoices.

Selling on Credit:

Due to the lack of unpaid invoice recovery, you won’t be able to extend selling on credit anymore and requesting upfront payment or deposits for new shipments or selling goods which may not go well with your client and result of decreasing your client base to other competitors because they provide easier payment facility and affect your market share at the end.

Client Relationships:

Recover your unpaid invoices can affect your business relationships with clients or supplier because of collection matters, nobody likes to wait until get paid, so it’s crucial to keep this in mind when communicating with the stakeholders and following up on them for the payments and keep a calm wise tone.

In Conclusion:

Unpaid invoices are not something you take lightly in your business you have deal with it in an assertive way whether in recovering, forecasting or analysis because at the end it is the revenue of your business and without heavy losses can damage your budget.

FAQs

What is the most effective way to collect unpaid invoices?

Maintaining clear communication with your clients. A friendly reminder email or phone call can often prompt payment without causing friction in the relationship. If the invoice remains unpaid, follow up with a more formal communication outlining the terms of payment and any late fees that may apply.

How do you politely chase an unpaid invoice?

Approach it with professionalism and courtesy. Start by sending a friendly reminder email that includes the invoice details, such as the amount due and the original due date. Express understanding that oversights happen, and kindly ask if they need any further information to process the payment.

How to respond to unpaid invoices?

Responding to unpaid invoices requires a blend of professionalism and clarity. Start by reviewing the invoice details, ensuring there are no discrepancies or misunderstandings regarding the amount owed or the payment terms. If everything checks out, reach out to the client politely but firmly. A simple email can suffice, reminding them of the outstanding invoice and requesting an update on payment status.

AW Holding

AW Holding