Debt Collection In Egypt

With a population of over 100 million people, the country is also one of the world’s most diverse and dynamic markets for labor, services, goods and innovation. Thanks to the Egyptian Government’s ambitious Vision 2030 initiatives, Egypt’s economy is attracting massive amounts of foreign investment and is projected to grow in a truly globalized manner across all sectors.

With this massive market growing at an exponential rate, AW Egypt offers B2B clients and corporates a suite of best-in-class solutions that are tailored to cater to specific end-to-end requirements. As an industry leader, AW Egypt is proud to be in line with Egyptian regulations, GDPR accreditation and all other relevant international standards.

AW Egypt boasts a clientele that spans Government and Semi-Government entities along the largest and leading national and international companies in several industries which include but are not limited to:

INTERNATIONAL TRADE & CREDIT

REAL ESTATE & DEVELOPMENT

CONSTRUCTION

POWER & TECHNOLOGY

HEALTHCARE & MEDTECH

TOURISM & HOSPITALITY

FINANCE

HEAVY INDUSTRY

AW HOLDING INT'L CORPORATE HOLISTIC GEAR

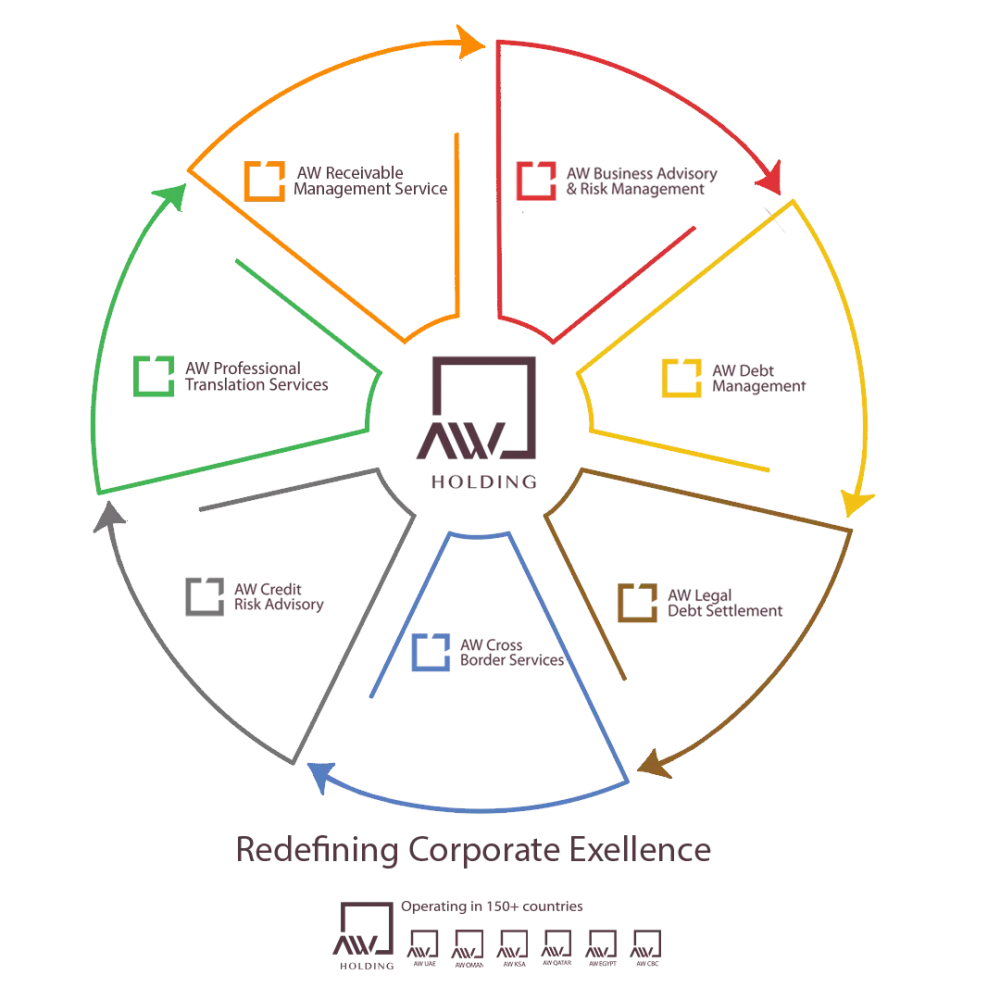

AW Holding INT’L team of 190+ top-tier specialists and consultants brings 28+ years of international and regional market expertise, global best practice and a break through holistic approach to debt management, legal debt settlement, cross border services, credit & risk advisory and professional translation. Beyond AW HOLDING INT’L’S end-to-end suite of solutions, AW Marketplace offers corporates seamless integration between our regional and international branches.

HOLISTIC END-TO-END CORPORATE SOLUTIONS

Preventive, Essential, Flexible

On- stop. Tailored. Transformative.

Fair. Just. Reliable.

Effective. Proficient. Comprehensive.

Global. Innovative. Proven.

Specialized. Committed. Cutting-edge.

Proficient. Accurate. Certified.

AW Holding

AW Holding