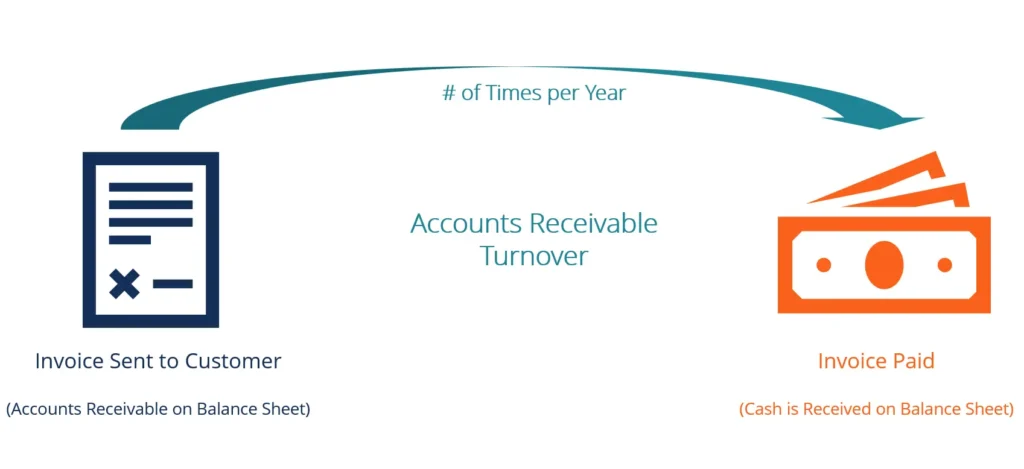

The accounts receivable turnover ratio is one metric that is used to measure how effective our collection performance for the accounts receivables, it depends on the sales amount based on credit to your clients and the collected amount of the invoices issued for those lines of sales.

bear with us in this blog as we are going to tell you the receivable turnover ratio examples, the formulas and receivable turnover ratio calculator and how to track it.

Table of Contents

ToggleWhat is the Accounts Receivable Turnover Ratio?

It is an efficiency metric that aim to measure how effective our collection efforts by turning the accounts receivable portfolio we have into cash in a specific accounting time frame usually between 30 to 90 days max. It is a strong indicator for expected cash flow and help us in decide whether to extend credit sales type to specific clients or not based on their payment commitment and responding to our collection attempts.

Receivable Turnover Ratio Example

Every company could sell its products or services on credit which means providing you with service or deliver the product to you for right away usage, issue an invoice for the price of this service or product and collect it later based on the terms and due date agreed on this issued invoice.

Based on the collection performance or the actual amount placed on the bank account from those sold services or products we can identify our receivable turnover ratio based on the below examples:

High Accounts Receivable Turnover Ratio:

Let’s say you are farming company owner; you have your own farms that produces different kinds of fruits and vegetables, also you manage your own distribution channels as well, you are working on HORECA model which means supplying hotels, restaurants and cafes with their needs of fruits and vegetables, you sell to the hotel brands on credit due to their creditworthiness but with cafes and restaurants you apply strict payment terms and collect in advance, at end of the accounting time the accounts receivable turnover rate is 10, which means the average accounts receivable is collected in 36.5 days (10% of 365 days) and this is from the hotel chains you are dealing with which indicates a good and higher AR ratio.

Average Accounts Receivable Formula:

Let’s imagine you have a pharmacy; you sell the medicines in cash but at the same time you have decided to deal and enroll in some medical insurance networks to have wider reach and expand your customer base, the medical insurance companies doesn’t pay immediately, they usually go to a long process of collection from their clients and pays your bills at last, on the other hand you need to pay some obligations on time like utilities, taxes, and buy new medicine shipments because your inventory is about to be out of stock, the cash amount you have from the clients you sell them out of insurance network got you covered for your purchases and payments until you collect your accounts receivable from the insurance companies.

Low Accounts Receivable Turnover Ratio:

You are an Exporter who export beverages for other country, the loading and unloading process takes some time, add to the logistics complexities until you deliver the shipments to the importer, after that the importer has un effective distribution channels and process that takes him time to sell the goods and transfer your money, you find yourself taking from 4 to 6 month to collect your invoice payments from the importer which affects your cash flow and result to lower receivable turnover ratio.

What is a Good Accounts Receivable Turnover Ratio?

As you see from previous examples you got a taste of what good accounts receivable turnover ratio looks like, if the turnover number is higher and increasing that’s mean OK, cause your ability to collect your cash and income is strong and this reflects to a stable financial position, if vice versa, you will need to evaluate your collection strategy to identify where your gap is.

How to Calculate Your Accounts Receivable Turnover?

Divide the net sales by average account receivables.

Net sales are calculated by subtracting sales returns and allowances from total credit sales.

Average accounts receivable is calculated by dividing the sum of the beginning and ending balances of accounts receivable over a specific period (Monthly, quarterly or annually) divided by two.

Accounts Receivables Turnover = Net Annual Credit Sales ÷ Average Accounts

Here is an Example: Example of Calculating AR Turnover Ratio

Scenario: A company, ABC Corp., has the following data for a year:

- Net Sales: $1,000,000

- Beginning Accounts Receivable: $100,000

- Ending Accounts Receivable: $150,000

Calculate Average Accounts Receivable:

Average Accounts Receivable= Beginning AR + Ending AR 2

Beginning AR + Ending AR /2

($100,000 + $150,000) / 2 = $125,000

Calculate AR Turnover Ratio:

Calculate AR Turnover Ratio= Net Sales Average Accounts Receivable

Net Sales / Average Accounts Receivable

$1,000,000 / $125,000 = 8

Interpretation: ABC Corp.’s AR turnover ratio for the year is 8. This means that the company collected its average accounts receivable approximately 8 times during the year. A higher ratio generally indicates better credit management and quicker collection of debts.

Note: Don’t forget to assess the performance of ABC Corp.’s AR turnover ratio, it’s essential to compare it to industry benchmarks or the company’s historical performance. A ratio of 8 might be considered good, but it depends on the specific industry and the company’s goals.

Tracking Accounts Receivable Turnover Ratios:

Keeping track of your accounts receivable ratios is vital for your business. If your ratios fall, it could indicate the need for tighter credit controls and increased collection efforts. On the other hand, if your ratios rise excessively, your credit policies and collection methods may be too restrictive, limiting sales.

By knowing how quickly your invoice payment terms, you can plan more effectively and have a clearer picture of your future cash flow and the ability to loosen up more with your clients in payment schedules.

How to Improve Your Accounts Receivable Turnover?

By implementing effective strategies to improve your receivable turnover ratio, you can enhance your business’s financial health and ensure timely payments. For a step-by-step guide on how to follow up on past due invoices.

Check out our comprehensive blog post. By following these tips, you’ll be well-equipped to collect outstanding payments and boost your overall financial performance.

In Conclusion:

A good receivable turnover ratio is essential for assessing a company’s efficiency in managing its credit sales and collections. This ratio indicates how effectively a business converts its receivables into cash, reflecting its overall financial health. A higher receivable turnover ratio suggests that a company is promptly collecting payments from customers, which can enhance liquidity and reduce the risk of bad debts.

FAQs

A high receivables turnover ratio is generally considered good as it indicates that a company is effectively managing its credit and cash flow.

A good Accounts Receivable (AR) to Accounts Payable (AP) ratio typically ranges from 1.0 to 2.0, indicating a healthy balance between what a company collects versus what it owes. This ratio reflects a firm’s efficiency in managing its cash flow; an AR to AP ratio below 1.0 could suggest that the company is struggling to collect payments, while a ratio significantly above 2.0 might indicate that the business is too reliant on credit sales or not managing its payables effectively.

The trade payable turnover ratio is a financial metric that measures how quickly a company pays off its suppliers. To calculate it, you need two key figures: the total purchases made on credit during a specific period and the average accounts payable during that same period.

The formula is: Trade Payable Turnover Ratio = Total Credit Purchases / Average Accounts Payable.

AW Holding

AW Holding