Accounts receivable aging is a crucial financial management tool that helps businesses monitor their past due receivables and assess the health of their cash flow. This process involves categorizing receivables based on the length of time they have been outstanding.

Understanding Accounts Receivable Ageing not only aids in improving collections but also provides insights into potential liquidity issues and customer creditworthiness, making it an essential practice for maintaining a robust financial position.

Table of Contents

ToggleWhat Is an Accounts Receivable Aging Report?

Accounts receivable aging report is periodic report to be generated on a regular basis to calculate and determine how much time the invoice is outstanding, meaning your customers unpaid invoices duration since the sales deal was closed, and to see the overall performance of collection activities for those invoices.

Add to that it helps you set alarms for risks associated with cash flow running by indicating the customers who have troubles paying their past due receivables on time.

This report is a valuable and helpful tool assisting you to creditworthiness of your customers along with any potential risk or issue that would affect your income.

When Is an Accounts Receivable Aging Report Used?

Accounts receivable aging reports are typically used on a regular basis, often monthly or weekly, to monitor the health of a company’s receivables. This frequency can vary depending on the industry, business size, and the specific needs of the organization.

If you need to assess the expected income or cashflow, the collection efforts and set targeted KPIs for your in-house or outsourced collection team or you want to evaluate the creditworthiness of customers and identify potential risks, or even providing some information for your financial and business reporting then you should add the report of the accounts receivable ageing to your list.

4 Benefits of Accounts Receivable Aging Method

Measuring and tracking past due receivables are very important so that companies can decide the best thing to do with those receivables in case of payment whether to sell those receivables for factoring companies, assign the task of accounts receivable collection to accounts receivable outsourcing companies, or persuade a legal action inside court against those clients to recover the outstanding amounts back.

Add to that other several significant benefits to businesses, here are 4 benefits:

1 – Improved Cash Flow Management:

Aging report sample in excel can help you predict the cashflow by categorizing invoices by age and anticipate when the customers could pay, also identifying potential shortfalls especially when you are dealing with a large portfolio of past due receivables.

2 – Enhanced Credit Risk Assessment:

With the outputs in the aging report sample in excel you can easily identify the high-risk customers by analyzing these outcomes and evaluate the credit policies to make the necessary adjustments.

3 – Improved Collection Efforts:

An account receivable report sample helps you prioritize the follow up efforts with customers who have over past due receivables, increasing the likelihood of timely payment.

4 – Better Financial Reporting:

Aging reports provide essential data for preparing accurate financial statements, such as the allowance for doubtful accounts, plus it will empower you with clear understanding of receivables, to make more informed decisions regarding pricing, credit terms, and overall financial health.

How to Calculate Accounts Receivable Aging

Accounts receivables is being listed and sorted based on the length of past due receivables, if the length is less than 30, 60, 90 days are considered current but if they passed 180 days it became old and have higher possibility to turn to bad debts, and if the payment status completed, they being removed from the records.

Account Receivable Report Sample

What is included in an Account Receivable Aging Report:

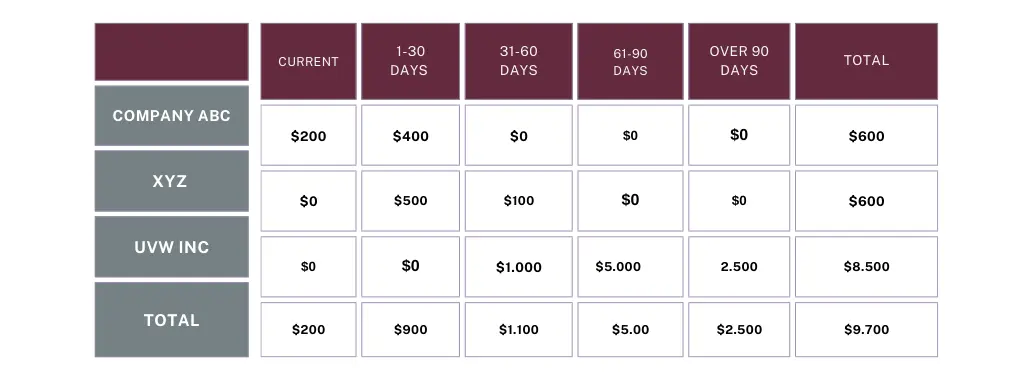

The report includes the balances of each customer past due receivables and sort the invoices into columns as follows:

- 1 to 30 days past due.

- 31 to 60 days past due.

- 61 to 90 days past due.

- Over 120 days past due.

Gain further insights into accounts receivable aging and understand the days outstanding, please explore our resources and download our aging of accounts receivable in excel.

What Is the Aging of Accounts Receivable Method?

The method is a technique used to estimate the number of bad debts the company is about to incur, and it goes as follows:

1 – Categorize Invoices by Ages:

Group them into age buckets such as 0-30 days, 31-60 days, 61-90 days, and over 90 days.

2 – Assign a Percentage to Every Bad Debt:

Calculate this based on historical data, benchmarks and category, older invoices usually assigned with higher percentage.

3 – Calculate the Estimated Bad Debt:

By multiplying the balance in each age category by its corresponding bad debt percentage.

4 – Sum the Estimated Bad Debts:

Add up the estimated bad debts for all age categories to determine the total estimated bad debt expense.

Sign up for our newsletter and receive actionable AR strategies!

Wrapping Up:

In the above blog we got to know the accounts receivable ageing, what does it mean, why is it important, how it affects your business, how to calculate it.

AW Holding

AW Holding