Accounts receivable typically account for 30-60% of a company’s outstanding debt, and here comes the importance of the Receivable Management Services, trying to reduce the percentage of outstanding and future bad debts.

Ready to learn more about how receivable management services can benefit your business? Keep reading to discover how this strategy can help you boost cash flow, improve customer satisfaction, and achieve long-term financial success.

Table of Contents

ToggleWhat accounts receivable means?

Accounts receivable management services is a practice concerned to one of the financial departments of the company whether the accounting department, finance or collection based on the company size and structure, this practice is concerned with managing and collecting the invoices of the clients who purchased the company’s service or products on credit base to ensure the firm dues are landed into its bank accounts in specific time so the accounts receivable outsourcing firm can have the needed cash flow In order to fulfill its obligations such as operation expenses, utilities, salaries, etc….

What are the accounts receivable process in BPO (Outsourcing)?

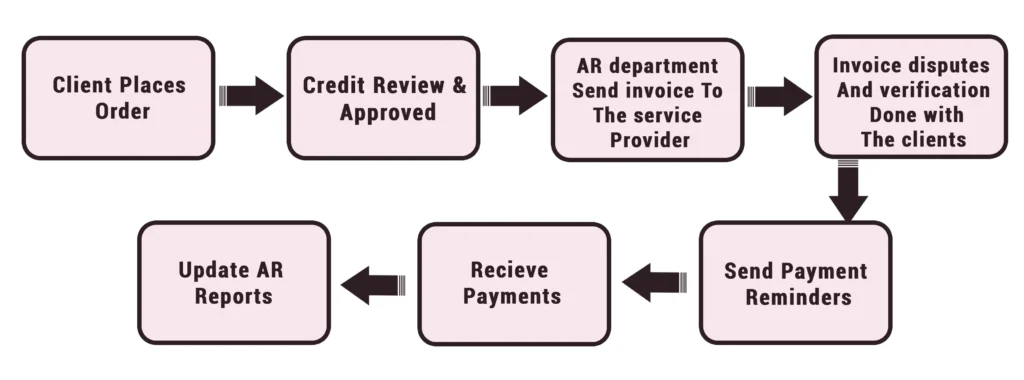

It starts with receiving the buying orders from the clients and based on financial planning, credit analysis and checks generated from every client credit report the client can get the approval to have the service or product purchased on credit till a specific agreed due date.

It could be 30 days, 60 days, or sometimes can even reach to 90 days with some industries, after that the company send the invoices to the accounts receivable outsourcing services provider or the outsourcing provider to start his verification stage early with customers addressing any disputes might happen that could lead to payment delays and prevent it from happening, then the Receivable Management Services provider begin to process outsourcing by putting a remaindering schedule to the customers and send notifications whether on emails, phone calls or even filed visits if required, to ensure receiving the payments on time.

What are the tasks of accounts receivable that are outsourced?

Accounts receivable consists of various wide tasks that’s where the idea of outsourcing it comes in as you can outsource some of the tasks or some of the accounts from A to Z to service provider to off load some of the over capacity on your team, and tasks of receivable management services includes tasks like:

- Coding Invoices.

- Vendor Management.

- Offering incentives for early payments.

- Invoice Processing & verification with the clients.

- Reconciliation and negation on payment plans and terms.

- Collecting Vendor Payment whether in cash, cheques or bank transfers.

- Communication with clients in the form of emails, calls or field visits if needed.

outsource receivable management firms can either help you with management consulting while you do the above activities or can help you with some specific tasks or take the lead on the accounts from A to Z till ensuring the amounts are collected into your accounts.

Benefits of Accounts Receivable Services with AW Qatar

Cost Saving:

Receivable management services can reduce costs up to 70% associated with new employment to your concerned department with the accounts receivable tasks such as finance department, accounting department, collection department or any other department who handle invoices and responsible for collecting like the sales engineering department.

Increasing Cash Flow:

Effective receivable management services can increase cash flow up to 20% by streamlining invoicing processes, implementing robust collection strategies, and utilizing advanced technology. These techniques ensure timely or even early payments. Professional account receivable specialists also minimize errors, working on improving customer relationships, and allows businesses to focus on core operations, ultimately enhancing overall financial performance and liquidity.

Business Growth:

Studies show that companies with streamlined receivable management services can reduce their days of sales outstanding (DSO) by up to 30%. which allows businesses to improve cash flow as mentioned in the previous point by collecting payments up to 15% faster. This timely collection not only boosts working capital but also reduces bad debt write-offs by approximately 25%, ultimately contributing to enhanced profitability and sustainable growth.

Reporting and Credit Risk Analysis:

Our service doesn’t stop at collecting the invoices on date, but effective reporting and credit analysis are essential components of our robust receivables management service and strategy.

Detailed reporting provides visibility into the accounts receivable portfolio, enabling businesses to monitor key metrics such as Days Sales Outstanding (DSO), average days of collection, aging of receivables, and collection effectiveness.

This data-driven approach supports informed decision-making around credit policies, customer onboarding, dealing with the same clients again or not, or even place a better terms and conditions on the new contracts, also provides you with overview of the collection efforts.

Watch Our Latest Webinar!

In conclusion:

Receivable management services offer a robust solution for businesses seeking to streamline their financial operations. By leveraging these services, accounts receivable outsourcing companies can focus on their core competencies whilst ensuring efficient invoice management of their accounts. This outsourcing model not only reduces operational costs but also enhances cash flow and improves overall financial performance. As Qatar continues to grow as a business hub, the demand for such specialized services is likely to increase.

Embracing Accounts Receivable Outsourcing Services can provide a competitive edge, allowing businesses to adapt to the evolving financial landscape and maintain a strong financial position in the dynamic Qatar market.

Is your business struggling with late payments and slow cash flow? Discover how professional receivable management services can help, contact Now!

FAQs

What is the Days Sales Outstanding (DSO)?

It is the average number of days taken to collect a payment it also sometimes refers to the average collection period.

What is the difference between accounts receivable and accounts payable?

In nutshell, accounts receivables are the amount of money you are about to receive for your services or products sold on credit, while Accounts payable outsourcing is the vice versa which are the amount you are to pay for supplies your company purchases, for example.

How much does accounts receivable cost?

It depends on the portfolio size of the accounts receivable handled, the chosen package from the service provider as well, in accounts receivable management it’s a fixed fees agreed between the client and the service provider.

AW Holding

AW Holding